Strategy - Why?

This post covers key learnings from a strategy class by Prof. Greg LaBlanc, organizer of unSILOed podcast.

What is Strategy?

Strategy is not about goal formation and goal accomplishment. Instead, it is about achieving a goal when other goal-seeking agents exist, whose goals may align or conflict with yours.

When Do You Need a Strategy?

| Does Not Need a Strategy ❌ | Needs a Strategy ✅ |

|---|---|

| Finding the fastest route to Berkeley from Palo Alto | Finding the fastest route to Berkeley from Palo Alto when others are also driving |

| Tying a tie | Tying a tie while kids are distracting you |

Strategy is essential in war, sports, and business.

Characteristics of Strategic Decision-Making

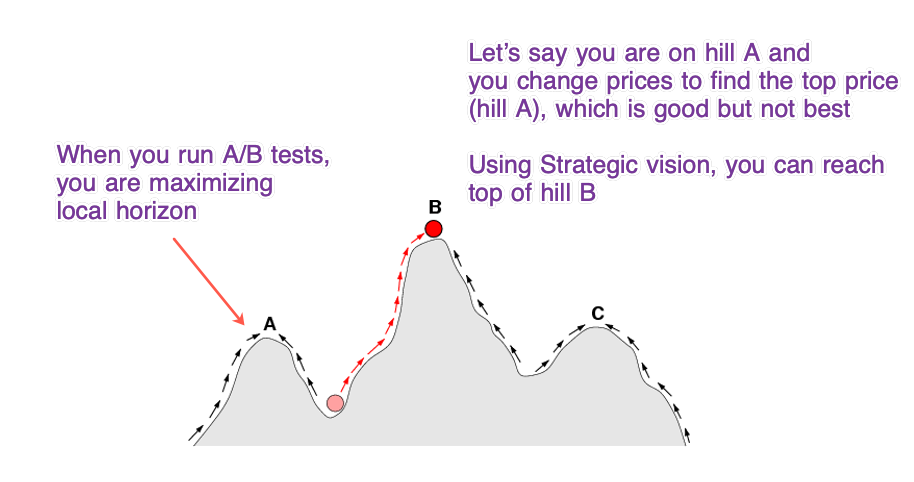

To be someone who makes strategic decision for a large organization, you need to be comfortable with complexity, opacity, and uncertainity aka Fog of War. If it's an easy problem to solve, then there are thousands of people who can solve. Only way to be competitive is by tackling something that's C-O-U.

- If you wait for certainty before making decisions, you will likely lose by being the last mover.

- In data-driven decision-making, waiting for a p-value < 0.05 (high certainty) is impractical in business.

Engineering vs. Strategy Mindset

| Engineering World | Strategy World |

|---|---|

| Seeks certainty | Embraces uncertainty |

Business is one of the most complex fields.

- Optimal Performance requires strong operations, whereas Sustained Performance requires good strategy.

- Strategy is dynamic and forward-looking.

- Best practices cannot be applied in isolation; companies play multiple strategic games simultaneously. For example, Apple competes or collaborates with Google, Samsung, Facebook, Foxconn, and Broadcom.

- A company’s payoff depends on the actions of other players.

The Role of a Strategist

A good strategist should:

- Become the world's best generalist (integrator), as experts can be hired for specific skills.

- Delegate as much as possible.

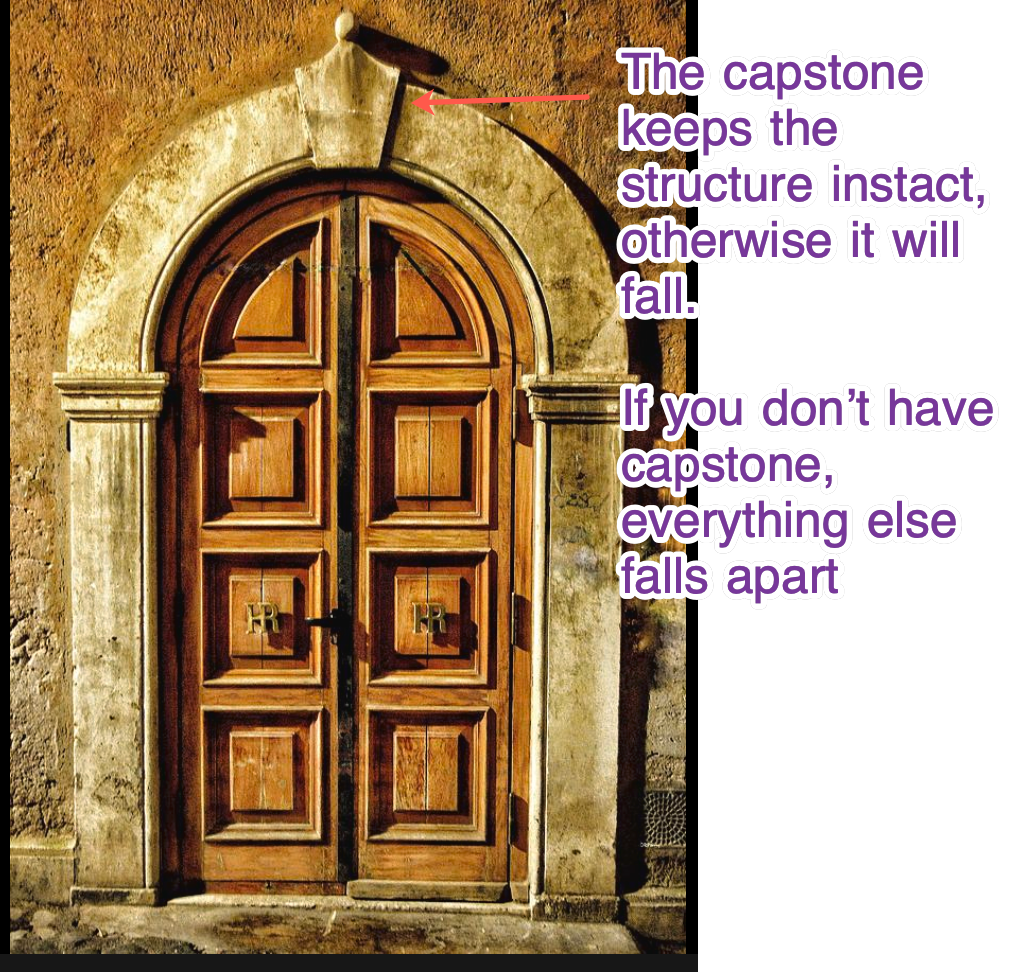

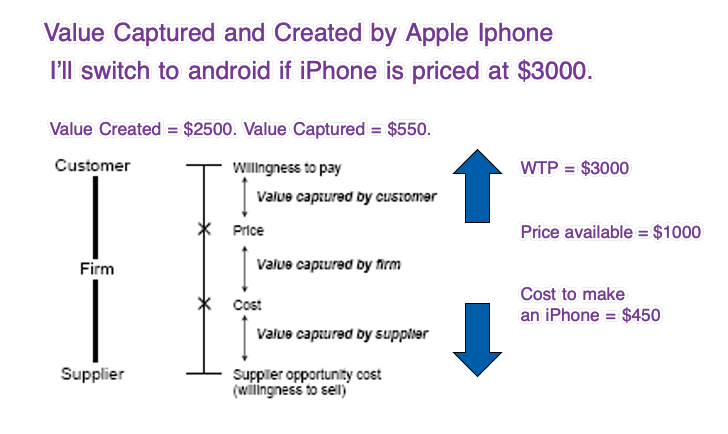

Value Creation and Capture

A firm’s true performance is measured as:

Revenue - Cost - Return on Market Value of Equity = Value Created by the Company

Most companies only capture a fraction of the value they create.

To increase profitability, a company can:

- Decrease costs

- Increase customer willingness to pay

- Increase volume while maintaining per-unit value

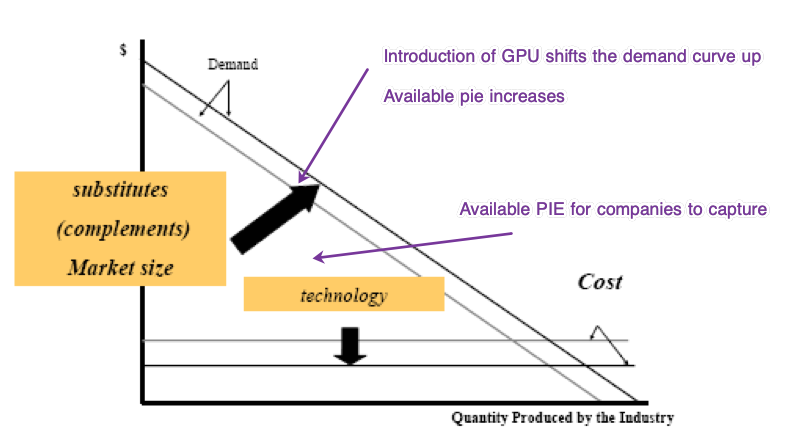

Potential Industry Earnings (PIE)

PIE = Value of industry output - Value of resources used to produce output

PIE represents the upper limit on industry profits.

Factors Influencing Industry Profitability

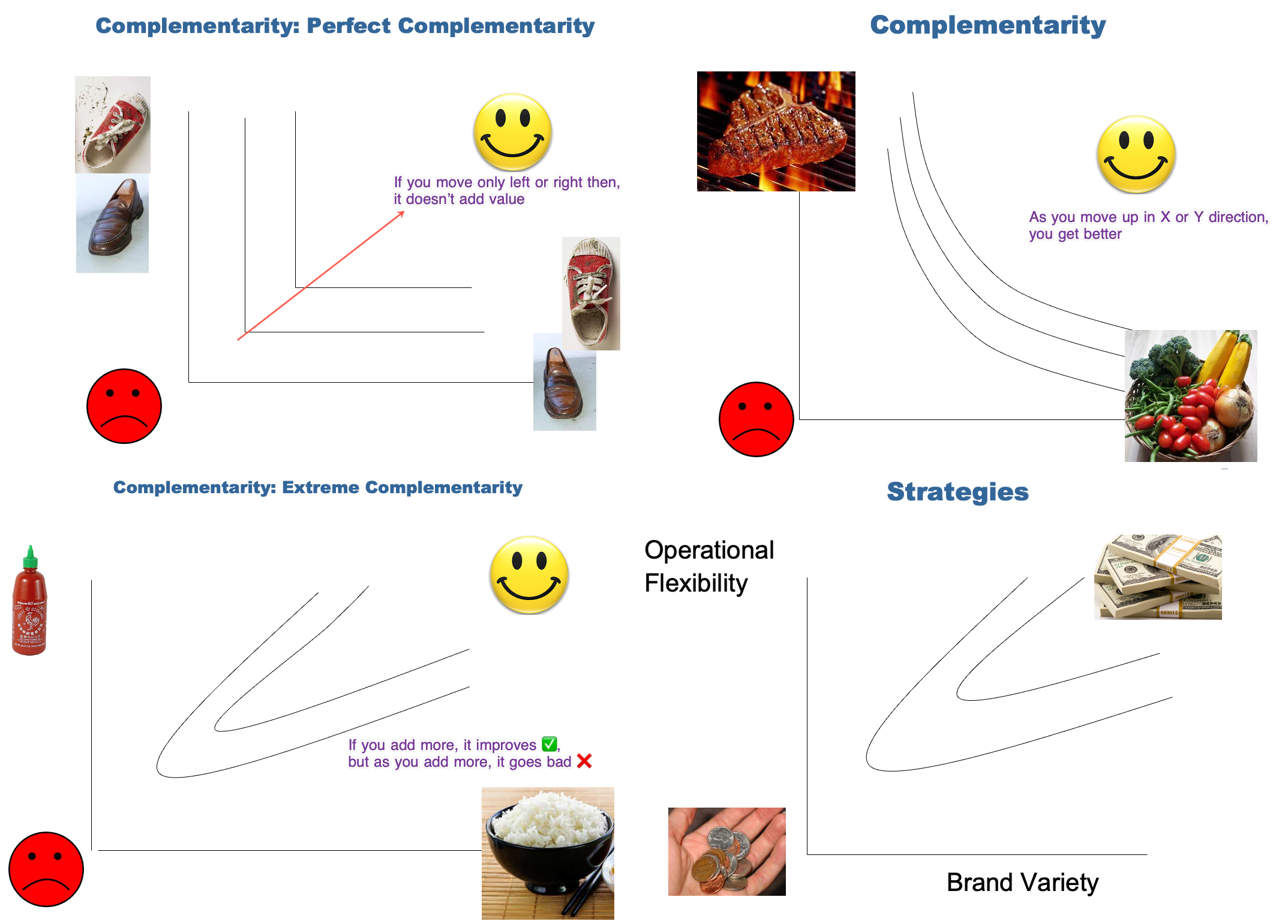

- Substitutes (bad ❌) vs. Complements (good ✅)

- Litmus test:

- If a product benefits you, it is a substitute.

- If the price of one product decreases and the other’s price also drops, they are substitutes.

- Examples:

- Tea and Coffee are substitutes—if coffee prices rise, tea consumption increases.

- Software and Hardware are complementary—GenAI software increases the value of GPUs.

- Litmus test:

- Supplier Bargaining Power (Weak is better)

- Example: Intel maintained very little bargaining power for its suppliers.

- Buyer Bargaining Power (High is better)

- Examples:

- Emirates has significant customer demand, enabling strong bargaining power with Airbus and Boeing.

- Walmart negotiates strongly with suppliers, but major brands like P&G also hold bargaining power.

- Examples:

- Barriers to Entry

- Examples: Legal constraints, trade secrets.

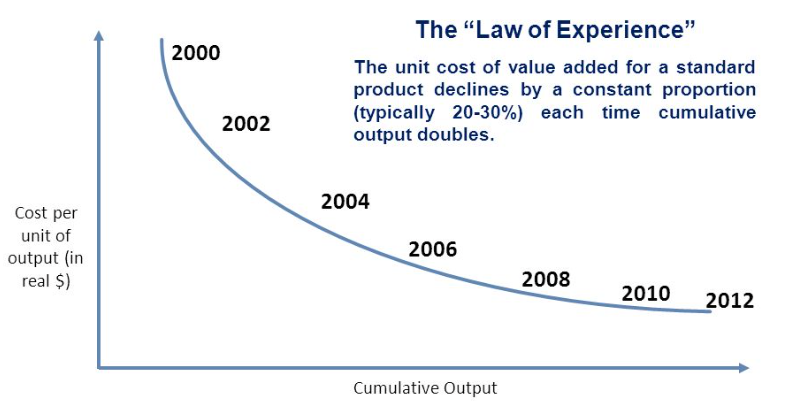

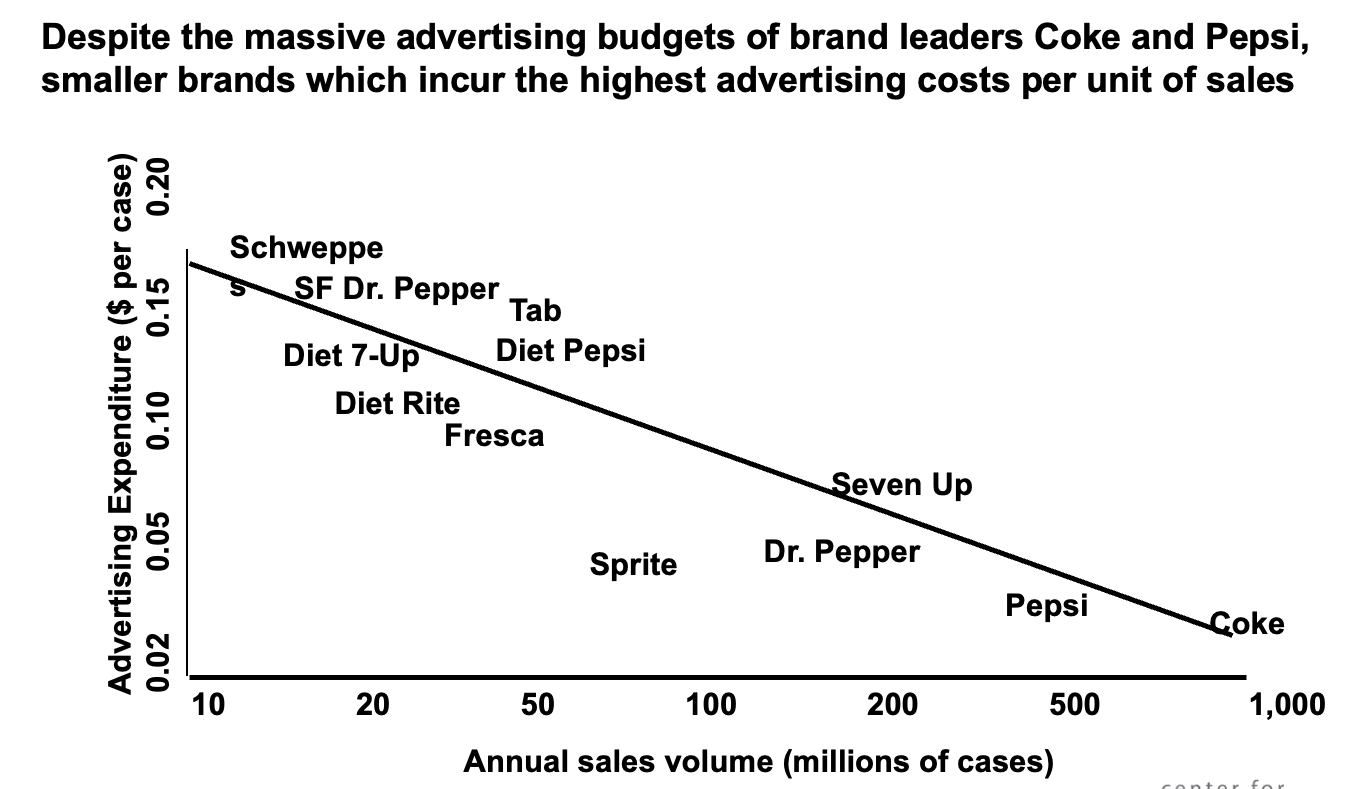

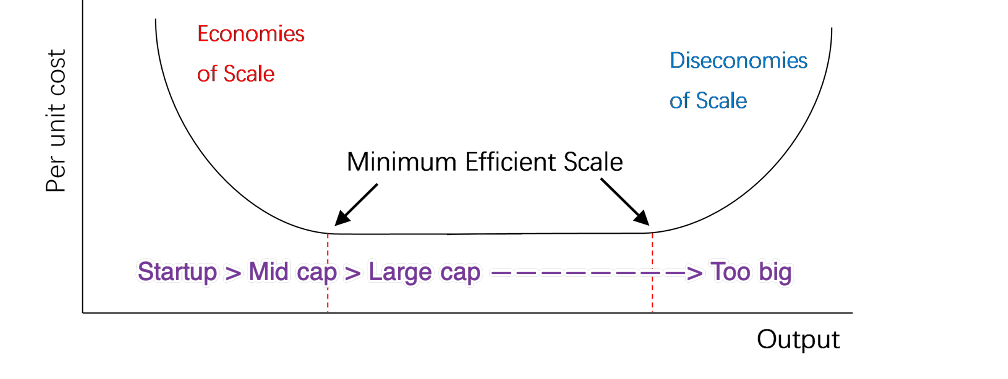

Impact of Economies of Scale

Case Analysis: Beer Industry

1. Industry Structure: Concentrated vs. Competitive vs. Fragmented?

- The beer industry is concentrated (few big players dominate).

- Economies of scale play a role—higher volume leads to lower per-unit costs.

- Companies transition from fragmented to concentrated as they grow.

2. Why Do Incumbent Beer Companies Grow Bigger?

- Change must be explained by change.

- Increase in average demand alone does not drive increased company output.

- Example:

- 1950s TV entertainment increased demand for bottled beer, impacting industry structure.

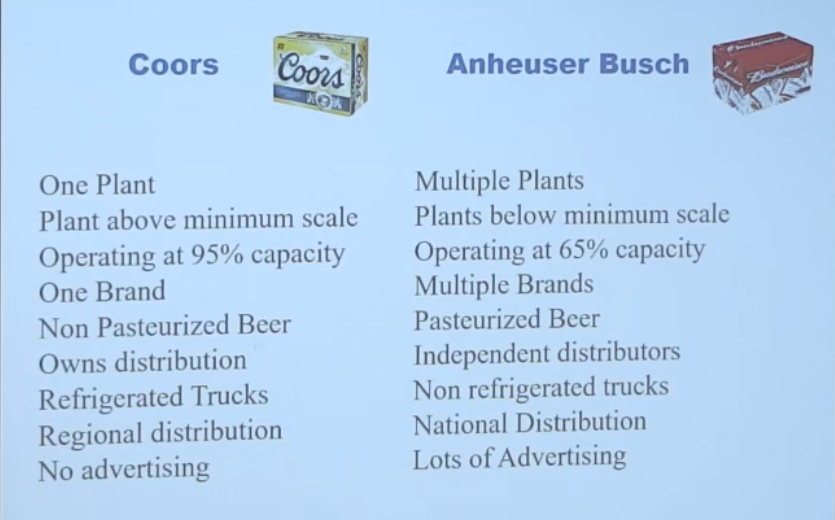

3. Why Did Coors Have Higher Profits Than Competitors?

- Lower costs due to a well-optimized value chain:

- Product Portfolio - Complementary product selection.

- Procurement - Efficient sourcing.

- Manufacturing - Operating at minimum efficient scale, ensuring high capacity utilization.

- Packaging & Distribution - Owning distribution improves quality control and minimizes losses.

- Sales & Marketing - Monopoly players require less advertising.

Key Takeaways

- Strategy is essential when facing competitive agents.

- Strategic thinking requires comfort with uncertainty and complexity.

- Sustained business success requires dynamic, forward-looking strategy.

- Profitability comes from cost efficiency, increasing customer willingness to pay, or scaling volume.

- Industries with economies of scale tend to concentrate over time.

- Competitive advantage comes from an optimized value chain.